Contents:

In addition, He has lot of clients and many new clients keep incoming, so even if he makes losses in first place, he can make do by making profit in second place. Financial intermediaries are the middlemen between these two types of people. CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax.

With this network of intermediaries and a tight regulatory framework, the US markets are dependable to a great extent. An Alternative Trading System or ATS is a trading system that meets all the requirements of stock exchange but is not required to register as one if it operates under the exemption provided vide Exchange Act Rule 3a1-1. They offer an alternative option for accessing liquidity and can be used to trade shares away from the normal market.

Many stock market participants rely on stock brokers to analyse the market and take investment decisions accordingly. Stock brokers can work individually or with a registered brokerage firm. The distinctiveness of financial intermediaries such as banks and insurance companies is the cause for their all-pervasive nature.

They use new-age technology and efficient system, and that’s why the fear of getting scammed comes down to almost 0. Let us first unlock some benefits of financial intermediaries through some quick bullet-points, and then we’ll elaborate on those points. Micro-finance activities prove that poor households can and do save rather than borrow, and it is possible to successfully mobilize funds from poor households. They are unable to access conventional credit and insurance markets to offset this. However, shares couldn’t be stored in a savings account and needed a special electronic place. Hence, in the nineties, these share certificates were converted into an electronic or dematerialized form.

This paper employs panel knowledge of 36 nations over the period from 1980 to 2015 to analyze whether monetary structure matters for the linkage between the insurance coverage and banking sectors. Panel co-integration checks find that the numerous relationship varies across completely different monetary constructions. Specifically, a developed financial system and market-based construction reinforce their long-run linkage. More importantly, the linkages between insurance and banking sectors may be complementary or substitutive, relying on the relative importance of risk transfer and capital allocation within the insurance coverage market.

Financial Intermediaries of Indian Capital Market

For stock trades to happen seamlessly, the market needed an organized platform where they could be listed. The Depository Trust Company is the largest securities depository in the world. It also assists in transferring ownership and maintains updated ownership records of all companies registered with it.

When an investor purchases shares, he needs to transfer funds to the broker. Hence, a bank is one of the essential financial intermediaries in the capital market. It allows SEBI to have a controlled environment during the transfer of funds. Special consideration might be given in analysing the position of financial intermediaries at preliminary public choices and secondary choices, based on the authorized framework in Serbia. Serbia, as different transitional economies, has issues in mobilising funds for its inventory trade.

The governing authority needs to make sure that no such instances occur. Also, it needs to make investors feel secure by creating an environment based on control and air-tight processes to improve investments in securities. To understand their functions in the marketplace and the role they play in providing a common platform to the players, one has to understand the types of Intermediaries. Depending on the type of intermediary, their functions are also predefined. You should also note that there can be intermediaries at various levels of a supply or distribution chain. Hence, these levels could be a parameter to decide the roles of an intermediary.

Securities Exchanges

Since its inception, the Modigliani-Miller capital construction irrelevancy principle has limited researchers’ curiosity within the role of economic intermediaries in macroeconomics. The paper focuses on the interesting case of France, where major reforms have liberalized monetary markets and the banking system and significantly widened the choice of markets and contracts for corporations’ financing. Banks make it far easier for a fancy economy to hold out the extraordinary vary of transactions that happen in goods, labor, and monetary capital markets. Imagine for a second what the economic system can be like if all payments needed to be made in cash.

The Reserve Bank defines ‘principal business’ as ensuring that only enterprises primarily involved in financial activity are registered with it, regulated, and overseen by it. Nowadays, when you buy a stock, you get an e-certification on your account, but earlier, it used to be physical papers. To store the e-certifications, you need a special electronic place, and that’s where we get DEMAT accounts and the concept of the depository. All the intermediaries provide you with a smooth and secure transaction experience, and as service charges, they take a small amount as commission, which is worth it. Such financial intermediation is governed by the Securities and Exchanges Board of India .

It is a trading platform where stocks and bonds trade and are bought. Banks keep valuable assets such as Money, gold, silver, diamonds, important papers, etc., and give loans at a particular interest rate. So he can make better investment decision compared to a new player in the sharemarket. He’ll invest part of your money in Government securities, or high rated corporate bonds, where profit is less but they’re more secure. If you are a Financial Advisor, then it is extremely important to stay updated on the latest financial terms. We at IndianMoney.com update all the new terms used in personal finance in the Financial Dictionary.

Open Demat & Trading Account Online in Just 5 Minutes

We are confident about our money, just because of financial intermediaries. The financial intermediary between lender and borrower is like a link or a middleman who governs the financial transactions and assures secure and safer investments. A financial intermediary is an institution or a body that collects savings from people who have surplus units, converts them into investments, and lends that money to borrowers. Pension funds may be defined as forms of institutional investor, which collect pool and invest funds contributed by sponsors and beneficiaries to provide for the future pension entitlements of beneficiaries. In the capital market, transactions go through three phases – trading, clearing, and settlement.

Without reducing costs, it would be very costly for investors and buyers to do transactions; that’s why we need financial intermediaries to make financial transactions easy and cheaper. For example, a stock exchange, as a financial intermediary, acts as the strongest link between a retail investor and a company raising finance from the public. A financial intermediary is an institution or a person that acts as a link between two parties of a financial transaction. The parties could be a bank, a mutual fund, etc., where typically one party is the lender and the other, the borrower. Since then, a microeconomic principle of banking has developed, mainly via a change of emphasis from the modeling of threat to the modeling of imperfect information.

The model has been extremely helpful in explaining the function of banks in the economy. It can be argued that financialisation is the appropriate framework to analyse processes of change in financial markets. The thesis also makes observations as to the true extent of presidency coverage autonomy in rising market countries, and policy recommendations regarding these governments’ perspective to financialisation. Traditional theories of intermediation are based on transaction prices and uneven data.

Balance Advance Brokerage can be refunded lifetime without asking any Question. Please note that the brokerage charged against the above scheme should not in any ways exceed the amount as specified under the exchange bye laws. Dear Investor if you wish to revoke your un-executed e-DIS mandate, please mail us with ISIN and quantity on dp@rmoneyindia.com by same day EOD. Inadequate financial infrastructure is another major problem in the region. Financial infrastructure includes legal, information, and regulatory and supervision systems. Inappropriate and extensive intervention by governments in micro-finance undermines its efficient operation.

Stock Exchanges:

You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India.

Decentralised finance – a threat for traditional FS firms, or an … – TechNative

Decentralised finance – a threat for traditional FS firms, or an ….

Posted: Sat, 31 Dec 2022 08:00:00 GMT [source]

In Germany a function of banks during reorganizations is to “use bank contacts to facilitate a merger with another firm as a means of resolving the crisis”. Healthy firms search around for the displaced capital of bankrupt firms but matching is imperfect and firms can end up with machines unsuitable for them. About 95 percent of poor households still have little access to institutional financial services. Most poor and low-income households continue to rely on meager self-finance or informal sources of finance. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Please read the Risk Disclosure documents carefully before investing in Equity Shares, Derivatives, Mutual fund, and/or other instruments traded on the Stock Exchanges.

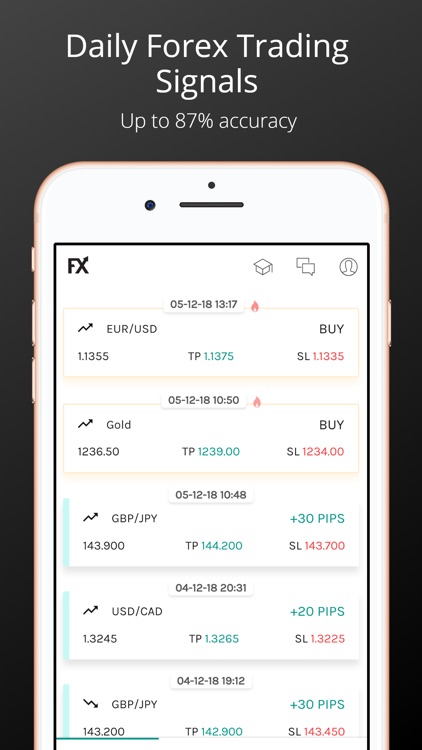

The stockbroker is one of the most important financial intermediaries in the stock market that play a key role in making transactions for you. It is a corporate entity that is registered as a trading member of the stock exchange. It holds a stockbroking license and works in compliance with SEBI guidelines to facilitate stock market trading. You need to open a trading account with a stockbroker in order to make financial transactions in the stock market. With the help of a trading account, you can buy or sell securities in the stock market.

Mortgage Lenders, Money Market funds, Insurance Companies, P to P lending are all examples of NBFCs. We need to consider the professionality of those financial intermediaries, and we should also consider how profitable they are and how they work and also look at their portfolio. We can define Financial Intermediaries as an entity that makes financial transactions very easy.

We have financial intermediaries examplesd the meanings of almost all the financial terms along with the context in which they can be used. If you have lingering doubts on any financial term, then all you must do is log on to our website and check out the Financial Dictionary. 24 years old Early Childhood (Pre-Primary School) Teacher Charlie from Cold Lake, has several hobbies and interests including music-keyboard, forex, investment, bitcoin, cryptocurrency and butterfly watching. Is quite excited in particular about touring Durham Castle and Cathedral.

Stocks, Treasury notes, Real Estate, and financial derivatives are all examples of investments. Intermediaries sometimes invest their clients’ money and pay them interest annually for a set time. They manage client assets and offer investment and financial advice to assist them in making the best investment decisions. Banks, insurance companies, pension funds, mutual funds etc. are the examples of financial intermediaries. The distribution of returns on initiatives, the charges charged by intermediaries, and the fraction of institutional holdings are all endogenous in equilibrium.

- If SEBI permitted that, then monitoring and controlling the quality of trades would be impossible.

- As the name suggests A mutual fund is a pool of fund created by a number of investors by putting their money in MF companies.

- The regulatory, supervisory, and deposit-insurance surroundings during which banks operate in each of these nations can also be in contrast and contrasted.

- However, in the US and UK competitors from monetary markets prevents this and risk administration should be completed using derivatives and different comparable strategies.

- Some financial services have developed a one-stop-shop for their clients.

Credit unions and building societies, for example, were established to provide financial assistance to their members. Individuals and businesses can purchase insurance from Insurance companies to protect themselves from risk and uncertainty, such as fire, death, illness, and business loss. Investment banks help with mergers and acquisitions, initial public offerings, and other services. A financial intermediary refers to a company or an individual who links two other parties involved in a financial transaction.

So, when a trade takes place in the market, the clearing corporation becomes the middle-man and facilitates purchase at one end and sale at the other. Additionally, clearing corporations regulate the delivery of securities and report data relating to trading activities. Furthermore, financial intermediaries such as banks are maturing into “financial hyper marts,” or umbrella institutions that cater to the complete demands of both investors and borrowers. A sub-broker is not directly linked to the stock exchanges but is a proxy member who has the necessary knowledge to act on behalf of the trading member. He can assist trading members and also investors in matters of securities dealing. It can be a person or a group of people or even an institution that manages money to be traded in the stock market.

Risks from leverage: how did a small corner of the pensions industry … – Bank of England

Risks from leverage: how did a small corner of the pensions industry ….

Posted: Mon, 07 Nov 2022 08:00:00 GMT [source]

The key mechanism used in the model employs a Glosten-Migrom market maker who progressively infers the worth of the elemental by buying and selling with each uninformed and imperfectly informed brokers. Information turns into “trapped” as purchases by the uninformed agent mask informative gross sales; a sudden value correction occurs as quickly because the market maker discovers the true value of the elemental. I also research the elements that affect the length of the data dissemination process. By providing loans to the unorganized sector and to small local borrowers, they support the banking industry’s role in addressing the corporate sector’s growing financial demands. They facilitate alternative financial services, such as investment , risk pooling, financial consulting, brokering, money transmission, and check cashing. SEBI provides every stockbroker with a stockbroking license, and without a license, it’s impossible to execute any trade.

In a stock market, or business, or any traditional marketplace, these intermediaries act as the connecting links between the producers and consumers. They facilitate intermediate action or transactions between those parties. They take funds from investors, and borrowers take that loan to make purchases.