Without a doubt, a credit limit is the best way to ensure that a customer will practice proper payment behavior when it comes to accounts receivable management. The alternative to setting up your own processes and software in-house is to outsource AR management to an accounts receivable management service. With robust AR management, an organization is able to better build and maintain customer loyalty. Allowing customers to make purchases on the basis of credit (in lieu of upfront payment) establishes a relationship of transactional ease. And strengthening that relationship happens by offering easy, consistent communication, particularly when it comes to payment.

Liquid Payments Revolutionizes Healthcare Payments with … – WV News

Liquid Payments Revolutionizes Healthcare Payments with ….

Posted: Thu, 22 Jun 2023 14:35:00 GMT [source]

Because of its reach, good AR management can impact the business in many ways. No business wants to be burdened by too many outstanding invoices or delinquent payments. Having healthy and reliable payments from customers ensures that you will have sufficient cash flow to fund the ongoing needs of your business. Working capital, cash flows, collections opportunities, and other critical metrics depend on timely and accurate processes.

What is Accounts Receivable Management?

Ultimately, whether you choose to outsource to a third party is up to you, but the importance of receivable management services is undeniable. Having an efficient accounts receivable management service – or partnering with a third-party who can provide that for you – can have a range of benefits for your business. Most importantly, it makes your unpaid invoices more manageable and improves your chances of getting paid within a reasonable timeframe.

Accounts Receivable Automation Market Is Booming Worldwide : Comarch, Kofax, HighRadius, FinancialForce – openPR

Accounts Receivable Automation Market Is Booming Worldwide : Comarch, Kofax, HighRadius, FinancialForce.

Posted: Tue, 27 Jun 2023 11:40:00 GMT [source]

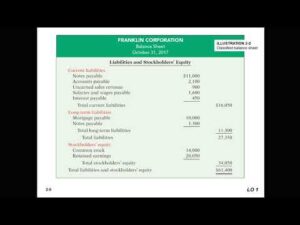

In order to manage cash flow and financial liabilities, you need accurate, up-to-date bookkeeping that makes it easy to track orders, balances, and other key order details. MAINTAIN ACCOUNT BALANCESYou’ll want to be certain that you update customer balances to accurately reflect payments so that nothing falls through the cracks. Both internal teams and customers should have easy access to real-time balances. This report tabulates the total amount of receivables outstanding for each client, as well as their duration. When aggregated, it is a useful assessment of receivables’ credit risk and collectability, and pinpoints financially problematic clients.

Once the credit limit is approved, the order shall be delivered along with the invoice. Once the payment due date approaches the team must follow up with PentaCorp’s accounts payable team and send a reminder. If the payment is received, the cash application team must check if the payment matches the invoices and if any deductions restaurant bookkeeping and accounting explained were raised by the customer, it shall be resolved. Typically, the more customers you have, the more successful your business. But that’s not the case if you’re struggling to keep up with timely invoicing and payment. Often the root cause of your collections and cash flow issues is simply a matter of poor internal processes.

What Is Accounts Receivable?

Most companies operate by allowing a portion of their sales to be on credit. Sometimes, businesses offer this credit to frequent or special customers that receive periodic invoices. The practice allows customers to avoid the hassle of physically making payments as each transaction occurs.

It’s also important to note that any receivable management service you work with will need to adhere to industry compliance standards, such as ISO 9001 for quality management. Choose Air Corporate as your dedicated accounting service provider and get world-class accounting, or more, for your company. However, by using automated tools and outsourcing to specialists, businesses can make the process easier and more efficient.

Set up Automations

From credit review, to manual print-and-post, to emailing and uploading documents to customer portals, human delay often holds up manual AR processes. With powerful automation, customers receive invoices without these obstacles and can thus make payments in a more timely manner. Your invoicing system should automatically send out invoices—and reminders about sent invoices, due dates, etc.—to customers after they place orders. Roughly 10-15% of invoices require a payment reminder, so the ability to automatically send these reminders is crucial to receiving timely payments. Automation eliminates the risk of billing errors, invoicing delays, and poor communication with customers.

When it becomes clear that an account receivable won’t get paid by a customer, it has to be written off as a bad debt expense or one-time charge. Accounts receivable are an important aspect of a business’s fundamental analysis. Accounts receivable are a current asset, so it measures a company’s liquidity or ability to cover short-term obligations without additional cash flows. Good AR management impacts cash flow and so many other aspects of the business. Attention to these details will provide reliable billing that can help make the process of accounts receivable run more smoothly.

Importance & benefits of receivable management

HighRadius’ RadiusOne AR Suite is built specially for mid-market CFOs which offers collections, cash reconciliation, credit, and e-invoicing app. With Artificial Intelligence all the solutions are integrated with each other so your company gets a centralized system to view all the AR processes in one place. In case of disputes, AR teams should explain each item to the customer and offer alternative solutions such as payment plans. Informing vendors about transaction terms before invoicing allows them to raise concerns beforehand.

- Businesses can extend credit facilities to their customers which will help them boost their sales volume, as more customers would avail this facility by purchasing products on a credit basis.

- Finally, an efficient process will help your staff stay focused on important, high-value work that supports your bottom line.

- BlackLine’s Modern Accounting Playbook delivers a proven-practices approach to help you identify and prioritize your organization’s critical accounting gaps and map out an achievable path to success.

- In fact, businesses who rely on manual AR processes take 67% longer to follow up on overdue payments.

Document the process, so everyone in your company follows the same procedures. A CCM system is essential for tracking customer info like contact details, contracts, and customer feedback and complaints (particularly those related to AR). Particular attention is paid to the customer’s liabilities (short and long-term) which impacts ability to meet obligations. Every executive is committed to ensuring transformational success for every customer.

Accounts Receivable and AR Management

Download the Excel-based credit policy template to create or update your credit policy document. This can be a great option for businesses that want the benefits of both options. Outsourcing also allows companies to focus on their core competencies and leave the AR management to specialists.

It should be remembered that a common trick of an unethical company is to find a new supplier, make a small order and pay for it promptly. A large order is then made and, having taken delivery of this order, the customer delays payment for a significant time. When you do sales on credit, you would certainly need to keep track of the due amounts that your parties owe you. Receivable management helps increase sales resulting in increased profitability. Businesses can extend credit facilities to their customers which will help them boost their sales volume, as more customers would avail this facility by purchasing products on a credit basis. Save yourself time and add consistency to your process by automating account communications with your clients and reducing manual processes when possible.

Best Practices to Improve your Accounts Receivable Management

Example

A company offers its customers 30 days credit but, at present, customers are taking an average of 41 days credit. In order to speed up cash collection, the company is considering introducing a 1% discount for payment within 10 days. The company finances its working capital requirement using an overdraft at an annual cost of 9%. This also helps increase transparency between your business and your customers, thus building a stronger bond with a lasting relationship. Accounts receivable staff work closely with sales and finance teams and are typically responsible for collecting revenue, recording transactions, verifying payments, and resolving discrepancies on accounts.

Our API-first development strategy gives you the keys to integrate your finance tech stack – from one ERP to one hundred – and create seamless data flows in and out of BlackLine. World-class support so you can focus on what matters most.BlackLine provides global product support across geographies, languages, and time zones, 24 hours a day, 7 days a week, 365 days a year. We are here for you with industry-leading support whenever and wherever you need it.