Companies may do this to increase their share price, such as if they need to satisfy exchange listing requirements or want to deter short sellers. A stock split occurs when a company increases the number of its outstanding shares without changing its overall market cap or value. The number of shares outstanding increases when a company issues additional shares or when employees exercise stock options.

Basic Shares Outstanding vs. Diluted Shares Outstanding

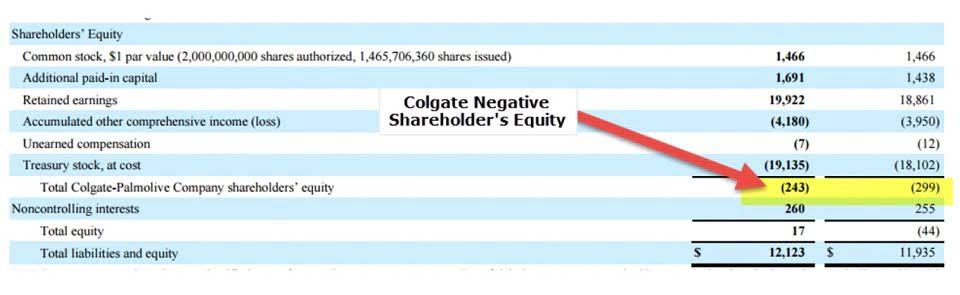

This is calculated as the basic shares outstanding plus any net new shares how to find the number of shares outstanding added as if all dilutive contracts were exercised. Examples of dilutive contracts include stock convertible securities, employee stock options and restricted stock units (RSUs). In particular, the common stock line of the balance sheet will typically have a number that equals the par value of each share multiplied by the number of shares issued. Therefore, if you have the balance sheet entry and the par value, you can calculate the issued share count. In some cases, there will be a separate line item on the balance sheet for treasury stock, and a similar calculation can tell you the number of shares issued but not outstanding. For blue chip stocks, multiple stock splits over decades contribute to market capitalization growth and investor portfolio expansion.

- It also has 10 million stock options outstanding with an exercise price of $5.

- If a company considers its stock to be undervalued, it has the option to institute a repurchase program.

- A company may have 100 million shares outstanding, but if 95 million of these shares are held by insiders and institutions, the float of only five million may constrain the stock’s liquidity.

- The company has 4.32 billion authorized common shares, of which 3,119,843,000 have been issued as of December 31, 2014.

- Outstanding shares are an important aspect of stock market trading as they have a direct impact on the company’s market capitalization and shareholder equity.

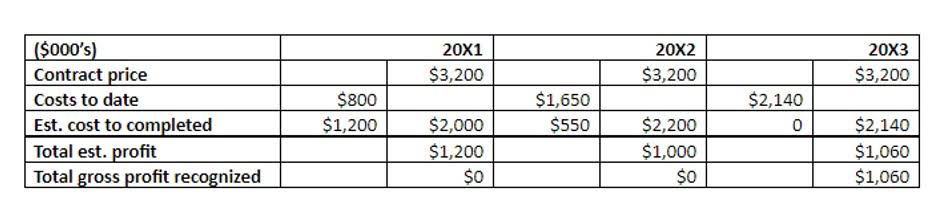

Weighted Average of Outstanding Shares

Explore how corporations authorize and calculate issued shares through market cap and balance sheet methods. When you buy stock in a company, you https://www.instagram.com/bookstime_inc buy a percentage ownership of that business. How much of the business your one share buys depends on the total common stock outstanding, a figure you can easily determine using the company’s balance sheet.

What Is the Difference Between Shares Outstanding and Floating Stock?

Issued shares are the number of shares issued by a company or the total number of shares in existence. Treasury shares are shares that had been issued but later bought back by the company as part of any share repurchases. The number of treasury shares held by companies is reported in the treasury stock account.

The market capitalization method

- A recent example of a reverse stock split is General Electric’s (GE) 1-for-8 reverse stock split during the summer of 2021.

- While shares outstanding account for company stock that includes restricted shares and blocks of institutional shares, floating stock specifically refers to shares that are available for trading.

- For instance, stock buybacks may increase the value of the remaining shares of stock and improve metrics such as earnings per share because there are fewer shares outstanding.

- This section provides the sum of the total authorized shares, the total number of shares outstanding, and the total floating shares.

- The weighted average shares outstanding or WASO adjusts for the impact of any share issues or repurchases during the year.

- Explore how corporations authorize and calculate issued shares through market cap and balance sheet methods.

A company’s number of shares outstanding is used to calculate many widely used financial metrics. Market capitalization — share price times number of shares outstanding — and EPS are both computed using a company’s number of outstanding shares. Basic shares outstanding are a company’s total number of shares available for trading in the stock market. It is the number of shares that have been authorized and issued to investors, which can be both institutions and individuals. One simple calculation for the number of shares in a firm comes from readily available information on a stock’s market capitalization. If you know the market cap of a company and its share price, then figuring out the number of outstanding shares is easy.

- Investors use market cap to categorize companies into large-cap, mid-cap and small-cap companies, which can help guide investors looking to diversify their investments.

- Learn about stocks that will split in 2024 and why a company might decide to do a stock split.

- A company’s outstanding shares decrease when there is a reverse stock split.

- Authorized shares, meanwhile, are the maximum number of shares a company can issue, based on its corporate charter.

- When a company buys back its own shares, that stock is accounted for as “treasury stock” on its balance sheet.

- The numbers of authorized, issued and outstanding common shares are listed in this section, along with the number of preferred shares.

A significant change in outstanding shares, such as through a stock buyback or issuance, can signal strategic shifts and impact investor sentiment. Because the difference between the number of authorized and outstanding shares can be so large, it’s important to realize what they are and which figures the company is using. Different ratios may use the basic number https://www.bookstime.com/ of outstanding shares, while others may use the diluted version.

- The number of shares outstanding in the balance sheet is as of the balance sheet date (December 31, 2018, in the example above).

- Preferred stocks are higher ranking than common stock, but also subordinate to bonds in terms of claim, or rights to their share of the company’s assets.

- Stock options will be exercised; restricted stock may vest after executives hit certain targets.

- Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful.

- For most companies, the number of authorized shares well exceeds the shares outstanding.

Outstanding shares are the shares in the hands of the public, executives and employees. They are the number of shares actually owned by the company’s shareholders. Here’s what you need to know about outstanding shares and how they’re vital to determining the value of a company. At the time, GE discussed plans to split into three companies and to divest from many businesses. They determined that reducing their share count from nearly 8.8 billion to roughly 1.1 billion better aligned with this vision (1).