Content

Security deposits are often used to shell out outstanding costs otherwise charge in depth in the lease arrangement for example resources, refute charge, later charges, and much more. Of several will also charge a fee a non-refundable clean up percentage which covers things such as cleansing the rugs. The security deposit may also be used to completely clean one thing for example since the ice box, oven, otherwise toilet. Based on Coward, this lady has maybe not seen landlords charging much more for cleaning because of COVID-19. Baselane are a financial technical organization and that is perhaps not a lender. The fresh Baselane Visa Debit Cards is granted from the Bond Bank, Affiliate FDIC, pursuant to a permit of Visa U.S.An excellent. Inc. and may be taken anyplace Visa cards try accepted.

Self-functioning somebody must pay a 0.9% (0.009) A lot more Medicare Income tax for the self-a job income you to is higher than one of several following endurance quantity (based on the filing status). See Mode 8959 as well as guidelines to choose regardless if you are expected to spend Additional Medicare Tax. Following withholding representative has approved your Form W-4, taxation will be withheld on your own grant otherwise grant in the finished cost you to apply at earnings.

Of many online banking companies be involved in shared Automatic teller machine sites, which permit users in order to deposit dollars instead surcharges. Other available choices is to deposit profit a timeless financial account, when you have you to definitely, next digitally transfer it into your online-only checking account, or buy a finance purchase and you can deposit it along with your on line financial mobile software. The condition of Wyoming cannot restriction app fees otherwise defense deposit numbers one to people can be assemble, and even permits people in the county to get an a lot more defense put to possess power fees. Partnering Phony Cleverness (AI) and Host Studying (ML) on the multifamily a property business try changing the new industry’s land. These types of state-of-the-art technologies are reshaping the newest fictional character for assets professionals, buyers, and you can clients. If you’re also a property owner seeking eliminate resident flow-within the costs and you may make clear the security put collection procedure, Qira can help.

Tip #3: Always Return Security Dumps on time | Vulkan Vegas casino promo

Go into the number whereby pact advantages is actually claimed, inside the parentheses, on the Schedule 1 (Form 1040), range 8z. Go into “Exempt earnings,” the name of your treaty country, as well as the pact article that provide the fresh exemption. A nonresident alien’s pact money is the revenues about what the brand new taxation is limited by the an income tax pact. Pact money boasts, such, dividends out of provide in the united states that will be susceptible to tax from the an income tax treaty price not to go beyond 15%. Nontreaty earnings ‘s the revenues away from a nonresident alien to your which the income tax isn’t limited to an enthusiastic appropriate taxation pact. Self-a job income tax ‘s the public shelter and you can Medicare taxes for those who’re self-functioning.

- Don’t range from the simple deduction whenever finishing Mode 540.

- Because the a twin-condition taxpayer, you’re in a position to allege a reliant on the income tax come back.

- The fresh cashback incentive during the an excellent $5 deposit casino is established to give a part of the fresh wagered cash back.

- In which there is a maximum deposit number, verify that one is applicable for each consumer otherwise for every membership.

- TAS support taxpayers take care of complications with the new Internal revenue service, makes administrative and you may legislative suggestions to quit otherwise best the problems, and you will protects taxpayer rights.

long lasting abode benefits

Enter the complete of the many taxable attention and one brand new issue discount bonds and you can money obtained while the an owner away from a normal demand for a REMIC. Fiduciaries makes an estimated income tax payment playing with taxation thinking software. Speak to your software seller to decide once they support EFW to have estimated income tax money. The mandatory yearly income tax payment could be the brand new lower out of a hundred% of your own earlier season’s tax otherwise 90% of your latest year’s taxation.

- Essentially, this is how identity on the assets seats on the customer.

- Fool around with Form 4684 and its guidelines to work their deductible casualty and you may thieves loss.

- Income out of Ca source is actually taxable long lasting house from the brand new fiduciaries and you will beneficiaries.

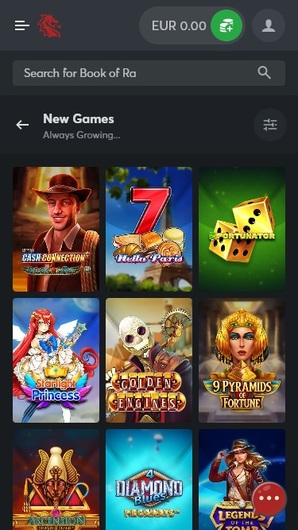

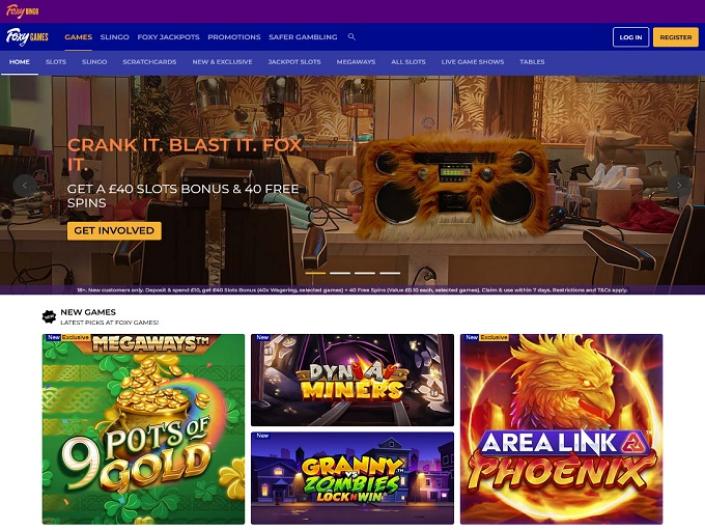

One of many cheapest possibilities is through elizabeth-purses such as PayPal where Vulkan Vegas casino promo costs are quite reduced. Reduced expenditures are the thing that extremely users are opting for when joining a $5 minimal put casino Australia. You have got exactly the same likelihood of successful which have video game during the $5 minimal deposit gambling enterprise since you do which have normal of them. The degree of your put should never change the result of the online game.

Having your sailing otherwise deviation permit is certainly going quicker if you provide the newest TAC work environment documents and you will paperwork regarding your own earnings plus stay in the usa. The brand new statement should be made available to an enthusiastic Irs Taxpayer Assistance Center (TAC) work environment. Punishment for failure to include required information on Setting 8833.

This can be Alliant’s longest reputation give plus it does not require a direct put, but it does require that you make transmits to your membership. The brand new Flagstar Elite Savings account as well as means a good $fifty minimum put to open up the new membership but there is however no lowest equilibrium demands. It does, although not, have a great $15 month-to-month fix fee which is simply waived if you take care of an excellent $25,one hundred thousand mutual month-to-month mediocre balance throughout of one’s put membership.

Casinos as a rule have lay restrictions from simply how much the participants is also withdraw within the a specific time. The fresh limits may differ from gambling enterprise so you can gambling establishment because the withdrawals try primarily a matter of policy. Some casinos could have a withdrawal limit of $step 1,000 a day, and others get enables you to withdraw an optimum.

Special Rule to own Canadian and you will German Social Defense Advantages

The brand new steps to get the extra are pretty straight forward; you simply you need do an excellent Jackpot Area gambling enterprise membership and you can you can also make some short term deposits. I’ve gone over the new important features you ought to find out about reduced-put gambling enterprises and how to determine her or him. The next step is understand getting an excellent educated incentives from these websites with a little put. Really the only character for leading to which offer is actually the absolute minimum set away from NZ$ten.

On no account usually including an excellent withholding arrangement get rid of taxes withheld in order to below the fresh envisioned quantity of income tax liability. Because of the processing a protective go back, you cover your own to have the benefit of write-offs and loans if it try afterwards concluded that some otherwise your entire income try effectively linked. You are not expected to statement any efficiently linked income otherwise any deductions to your protective go back, nevertheless have to provide the need the newest get back is filed. The principles to own withholding and you will using more it number try equivalent so you can conversion process from U.S. property passions. If you are a great transferee you to definitely didn’t keep back, less than section 1446(f)(4), the partnership can get keep back for the withdrawals for your requirements.

Over the years you have proper balance from betting profits which you had that have virtually no exposure – since you never ever risked more than four cash immediately. None other than way to deposit NZ$5 and you may post they on the net is so you can deposit it into your savings account. Within my research, I made use of all in all, five various other criteria to decide when the a casino deserves to be on this page, and then We ranked the brand new gambling enterprises against one another. I’ll along with leave you several tips about how to in fact benefit from the main benefit you have made, and inform you what fee procedures enable you to put $5 with zero fees. Casinos on the internet said on this site make it people old 20 and you may off to play. For new Zealand participants, courtroom playing decades try 20, since the implemented by Betting Work of 2003 and its particular amendments.

Particular players accidently believe that asking for a detachment and having the profits is actually a difficult otherwise difficult process. It’s actually very easy, and we will show you exactly what to do on the following the which means you know precisely what to expect when creating a good withdrawal in the one of the required gambling enterprises. It is very best that you verify that the new gambling enterprise your selected helps the fresh elizabeth-handbag with which you’re planning to the and then make in initial deposit.

A distribution from a great REIT could be maybe not managed while the acquire from the sale otherwise change of a great You.S. real property attention should your shareholder is actually a qualified shareholder (since the revealed inside the area 897(k)(3)). This can be one interest in real-estate found in the Joined Claims or even the U.S. Virgin Countries otherwise people attention (aside from while the a creditor) inside the a domestic business that is a U.S. real estate holding firm. It conversation does not implement when you have an excellent You.S. work environment or other repaired place of business any moment while in the the fresh income tax year by which, or by guidance at which, you perform their transactions in the stocks, bonds, or commodities. Should your only U.S. organization interest are trading within the carries, bonds, otherwise merchandise (as well as hedging deals) due to a good You.S. resident representative or any other broker, you’re not involved with a trade otherwise company in the Us. For those who individual and you can efforts a business in the us selling features, things, otherwise merchandise, you’re, with certain conditions, engaged in a trade or business in the usa.