Answering these questions will give you an idea of the resources you need to dedicate to the cleanup project, which will help set your price correctly. Both can be handled by getting organized, improving communication with clients, and automating tasks. This will catch any transaction posted to an account after it has been reconciled and avoid messes for everyone. The first step is receiving client information (which can often be the most challenging step in the process). You may receive your client information as a physical or electronic file. The best bookkeeping method depends on the size of your business and your comfort level with automated technology.

Collect all your financial records

As a bookkeeper, it’s your responsibility to keep your clients’ books in order. Imagine a power outage corrupting your bookkeeping software, a hardware malfunction erasing your files, or even a cyberattack compromising your system. After all your hard work cleaning up your books, the last thing you want is to lose that valuable data. This signifies no unadjusted entries were made in prior years, simplifying tax filing.

- Don’t worry—you don’t have to spend hours sifting through mountains of paper.

- There are automation systems that exist today that can automate bank feeds, streamline client data collection, and give you templatized recurring processes.

- Messy, incomplete, and inaccurate bookkeeping can lead to a slew of issues that cost more than just time.

- With all the automatic importing of transactions and automatic categorization, it can be easy to overlook this step.

- By checking your payroll records, you can ensure that all payments and deductions have been appropriately documented and that you comply with all tax requirements.

steps for bookkeeping cleanup (and free checklist)

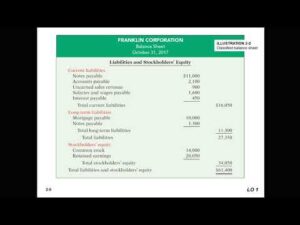

You can use this report to find out how profitable your business is and determine the cost of running your business. This report also allows you to forecast your sales and expenses for the next fiscal year. By auditing your receivables, you can ensure that all unpaid bills are appropriately recorded and that you follow up with clients/customers who still need to pay. Depending on your bookkeeping software, you may be able to automatically categorize transactions as they occur, which helps keep your bookkeeping retained earnings on the balance sheet updated. An accounting professional can help you unravel and clean up accounting records. To learn more about how these and other Karbon features can help automate aspects of the bookkeeping cleanup process, book a demo or start a free trial.

You can evaluate your accounts receivable and payable, payroll, inventory, and tax filings, clean up your chart of accounts, and back up your data by following these procedures. Sort through invoices, credit card statements, receipts, bank statements, and other necessary financial data. At this point, you should identify any missing information and reach out to your clients for clarification or additional documentation. It’s similar to reconciling your bank accounts to reconcile your credit card balances. It requires verifying that all transactions are appropriately recorded by comparing your credit card statements to your accounting software. Comparing your bank statements to your accounting software to ensure all transactions are appropriately recorded is reconciling your bank accounts.

You can extraordinary items on income statement use this bookkeeping cleanup checklist to help you stay on track. The good news is the more consistently you do this, the less time it will take. If your greatest discovery during this process is that you don’t have the time, energy, or knowledge to do this on your own, it’s time to outsource your bookkeeping.

Untangling Expenses

The information in this guide is based on the Bookkeeping Best Practice template from the Karbon Template Library. This is also an opportunity to reach out to your professional network and see if anyone else has identified tools to make processes run smoother.

You are looking to gather all of your bank statements, receipts, invoice, and other related financial information. By dedicating designated time slots for bookkeeping tasks, you can consistently categorize transactions, reconcile accounts, and monitor your financial health. This regular upkeep prevents small issues from snowballing into a future clean-up project. Think of it as an investment in your financial well-being, ensuring you have easy access to accurate and up-to-date financial information whenever you need it.

Financial institutions allow access to bank feeds which allow you to in quickbooks online import most transactions directly. Our 12-step guide and downloadable checklist transform the bookkeeping cleanup process from a daunting task into a manageable system for solopreneurs and small business owners alike. If you’re new to bookkeeping checklists, this is a great place to start your journey towards being more efficient. If you already have a checklist going, then you’ll surely find some gems to add to it below.