Content

Depending on the company, you can speak with your bookkeeper (or team of bookkeepers) as often as you’d like or at least a few times per month. The two fundamental components to how much getting your books done costs are transaction volume and dollar amount spent. Transaction volume is just simply how many transactions does your company have every month?

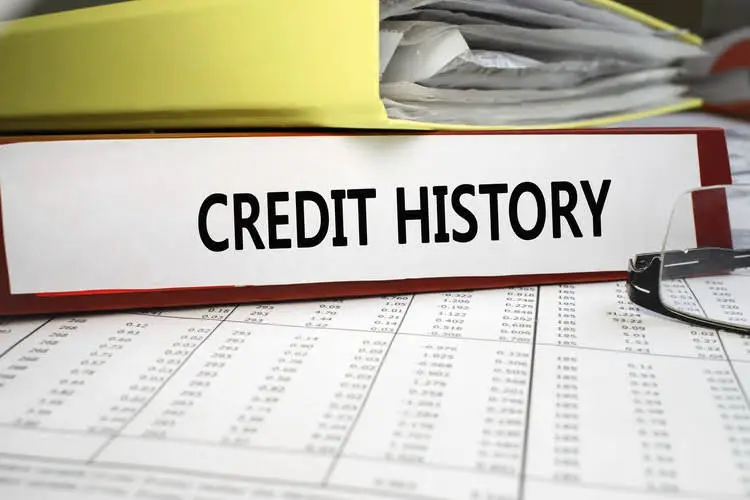

One of the ways that startup founders most frequently create bookkeeping and accounting messes is by failing to open dedicated accounts for their business when they get started. Cash basis accounting is focused on cash inflows and outflows, and is best for businesses with simple financial transactions. While it’s true that you are ultimately responsible for your finances, bookkeeping and accounting assistance can provide an extra layer of security. In general, however, accounting software for startups typically costs between $50 and $200 per month. This type of accounting can be beneficial for small businesses because it provides a more accurate picture of a company’s financial health.

You be the Entrepreneur, we’ll be your Accountant.

Accounting is deciphering your financial records for everything from paying the right taxes to strategic business decision making. While bookkeeping is there to ensure the process of tracking all financial records is complete. At Kruze, we’ve built our own, in-house automation called Kruze Keeper, which automatically recognizes the text from the bank feed for most transactions, about 75% of the transactions. Kruze Keeper can automatically get those transactions into QuickBooks without an accountant having to touch it. This helps us keep the cost of delivering bookkeeping services down.

KPMG offers a range of services for small business owners, including cash basis accounting and tax preparation. It allows users to answer a few questions and incorporates the company based on the bookkeeping for startups answers. It helps users by providing incorporation documents, tax filing solutions, creating business accounts, etc. It offers solutions such as bookkeeping, tax filing, payroll management, etc.

How Good Bookkeeping Pays for Itself

Lendio offers free accounting software for small businesses that can automatically track your transactions. A good bookkeeping service will save you time and money by keeping track of your finances and making sure that your books are in order. When choosing an accounting firm, be sure to ask about their monthly expenses, tax services, CFO services, and tax preparation. When it comes to bookkeeping and accounting for small businesses, the cost of software can vary depending on the features and services that are included.

Each may offer slightly different services and features, so choose the one that best suits your business needs. Online bookkeeping services are a hybrid of bookkeeping software and professional accounting. You get the benefit of the assistance of a pro bookkeeper with the flexibility of managing what you want to manage. If financial terms like income and expense, debits and credits, and balance sheet make you cringe, you probably aren’t alone.

Get squeaky-clean books

And unless you have the budget to hire an in-house accounting department, you might not know what your options are in terms of making sure your bookkeeping gets done properly and on time. Third parties may or may not require https://www.apzomedia.com/bookkeeping-startups-perfect-way-boost-financial-planning/ your cash flow statement, but it’s essential for informing management decisions. Running out of capital is one of the most significant dangers for startups, and a cash flow statement helps you see that coming.

- However, there are some records you may keep longer than three years to provide information for potential questions.

- If your business has more transactions than you have time to track each day, hiring a bookkeeper is probably a good idea.

- Assuming that the startup has a bookkeeping software like QuickBooks Online set up, we recommend one of the founders DIY the books until the company has raised a reasonable amount of funding.

- With Pilot, you get an advisor who knows your startup business and growth stage.